Harvest reflections: How key wine regions view low global production

In early November this year, the International Organisation of Vine and Wine (OIV) released its initial estimates for global wine production in 2023, painting a rather gloomy outlook for the industry. The projected total output of 244 million hectoliters indicates a 7% decline compared to 2022, and the lowest crop level for 60 years. Unfavorable weather conditions, such as early frost, heavy rainfall, and drought, have had a significant impact on vineyards globally, leading to a substantial decrease in harvest volumes in both the Southern Hemisphere and key wine-producing countries in Europe.

To further explore these statistics we sought the expertise of wine professionals in some of the impacted countries to hear their insight about the situation and provide a valuable understanding of the current state of the global wine production landscape.

Italy: a positive outlook despite the production shortfall

Dr. Riccardo Cotarella

Italy experienced its smallest harvest since the historically low crop in 2017. Consequently, it relinquished its title as the world’s top wine producer for the first time in nine years. The OIV anticipates a 12% decrease in Italy’s wine production by volume, but according to Dr. Riccardo Cotarella, chairman of the Italian Oenologists Association, the reduction is likely to exceed 12%, and fall more in the range of 20-25%, equating to a significant loss of 10-13 million hectolitres. “Naturally, regions are not uniformly affected”, clarifies Dr. Cotarella. “The central-southern regions, particularly Abruzzo, have been hit the hardest, experience extraordinary declines ranging from 55% to 65%.”

Fortunately, due to the favorable quality of previous vintages, there is little likelihood of a dearth of Italian wine. “Despite the low harvest this year, we consider the situation as not entirely negative”, admits Cotarella. “Our substantial stocks from previous seasons, which are above average, will ensure a balance between supply and demand, thereby contributing to an upward trend in the average price of wines in the market.”

France: regional contrasts and changing market dynamics

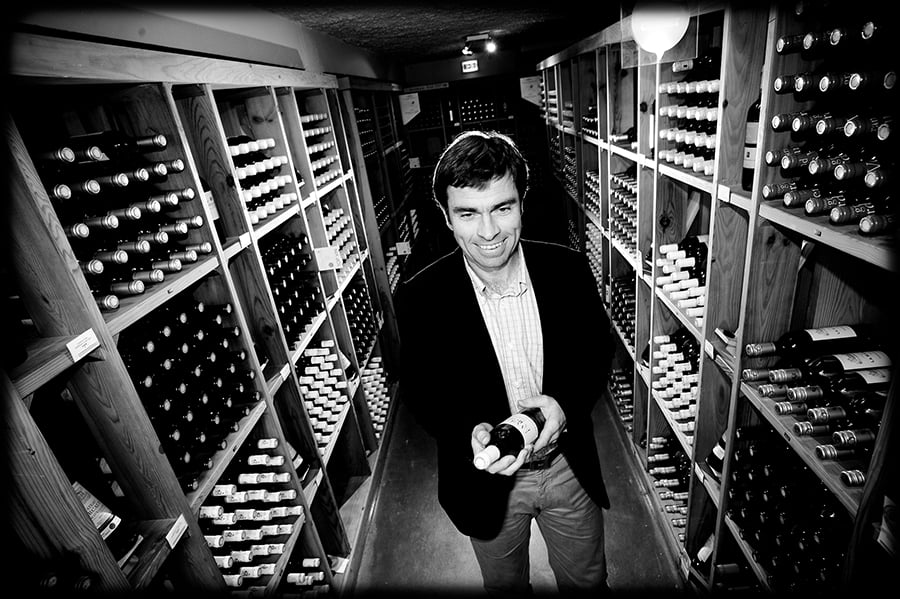

Bernard Farges – Photo Echos de Bordeaux

The substantial decline in Italy’s wine production has allowed France to reclaim its position as the world’s leading wine producer in 2023. In fact, France is estimated to produce 45.8 million hectoliters, on a par with the 2022 crop.

However, despite the overall consistency in French production compared to last year, according to Bernard Farges, chairman of the National Committee for Appellation and PGI Wines (CNIV) the situation across the French wine regions offers a mixed picture. Cognac and Champagne experienced a bumper harvest, boasting incredible yields. Alsace, Burgundy, Beaujolais, and Savoy also enjoyed a bountiful crop, whereas the South of France encountered more challenges. Bordeaux and the entire South-West of the country grappled with a significant outbreak of powdery mildew, leading to a substantial reduction in volumes. Gascony also faced considerable damage from hailstorms affecting the vineyards. The Rhône region anticipates a decline bordering on 17%, mainly due to adverse weather conditions and lower authorized yields set by the industry. In Languedoc, Roussillon, and Provence drought exerted a sizeable impact on harvest volumes.

“The figures exemplify the fact that France’s symbolic first place can predominantly be ascribed to two major regions, Cognac and Champagne, which truly tip the scales, while the harvests in Burgundy, Beaujolais, or Alsace carry much less weight”, adds Farges. He goes on to explain that “the effects of the 2023 harvest in the prominent regions will only become evident in a few years’ time due to the distillation process in Cognac and bottle aging in Champagne.”

Regarding the supply-demand dynamics in the market, Farges predicts that the increased grape volumes in Burgundy will allow more wines to enter the market. However, the impact is expected to be moderate: “The plentiful harvest in Burgundy will somewhat ease market pressures. However, the difference in supply is not very significant, and demand continues to be robust. Consequently, there is every likelihood that tensions may arise, particularly in the entry-level markets, driving prices upward and making the wines more lucrative.”

Spain: the global consumption slowdown allays fears of scarcity

José Luis Benítez

Conversely, Spain is not anticipating supply shortages despite its low wine stocks, primarily because of an overall decrease in wine consumption. The third-largest wine-producing country globally experienced a 14% decrease in volume compared to 2022 and a 19% drop versus its last five-year average. José Luis Benítez, managing director of the Spanish Wine Federation, analyzes the situation: “With a reduced harvest in Spain, similar to the situations in Italy and some Southern Hemisphere countries, you might expect an increase in wine prices in the market. However, there is currently a sluggishness in the international red wine market, amplified by various global economic and political factors that have been slowing down overall wine consumption. These conditions fail to create a sense of scarcity in the markets. Although inventories are among the lowest for the past 20 years, there is no cause for alarm at the moment.”

He goes on to explain that if shortages in Spanish wine exports do occur, they are likely to affect the white wine category: “There is a noticeable uptick in demand for white wine in international markets, potentially leading to a more significant increase in prices and even suggesting possible scarcity. For the red wine market, however, there are no signs of inventory tensions at the moment that could complicate supplies.”

South Africa: strategic advantage

Maryna Calow

In the Southern Hemisphere, South Africa is among countries struggling with low production volumes this year. The 2023 harvest witnessed a drop of 14% compared to last year primarily due to fungal diseases, especially powdery and downy mildew.

Maryna Calow, Communications Manager at Wines of South Africa, shares her perspective on the decline: “At present, this isn’t a cause for concern, as it positions us favorably in response to the current market demand for wine, both locally and internationally. One of the longstanding challenges for the South African wine industry has been having some of the lowest wine prices globally. The reduced wine supply is likely to lead to price increases, especially considering that our quality has never been better. There is still strong demand for our wine internationally, notably in our white wine segment.”

Marina Calow also emphasizes the global decline in wine consumption. While the industry is hoping for a shift in this trend, the current reality doesn’t seem as bleak as it appears.

Whilst facing the lowest wine production levels in six decades, industry professionals are expressing a positive outlook, emphasizing their adaptability and strategic positioning. The potential reduction in wine supply in certain countries is viewed as an opportunity for price increases, especially when the outstanding quality levels are factored in. Against a backdrop of declining global consumption and high stock levels in various regions, the anticipated low production holds the potential to reestablish equilibrium in the global marketplace.

Valentina Phillips